How to Optimize Revenue Cycle Management for Maximum Efficiency

19 Sep 2025 By: Vlade Legaspi

Updated

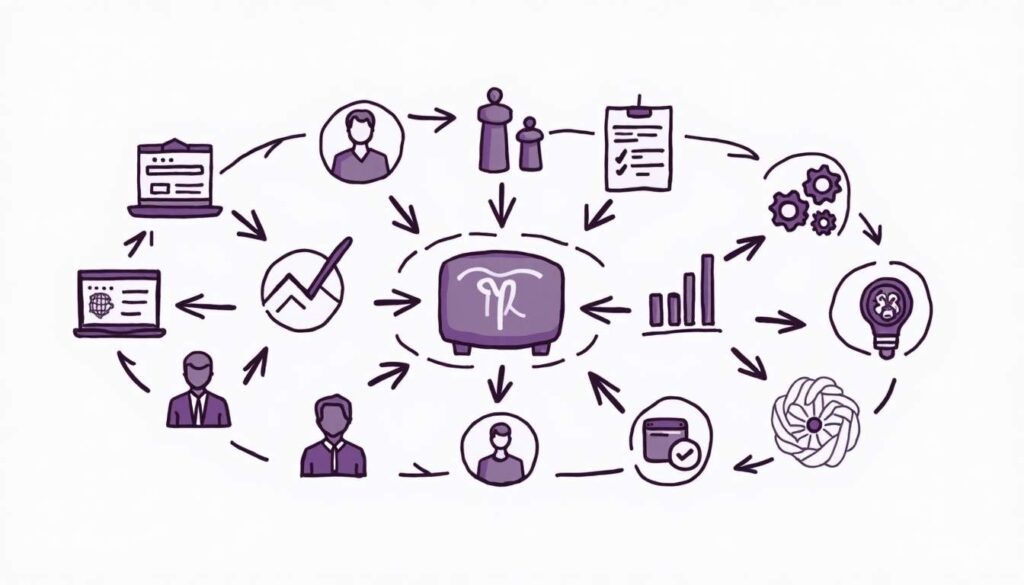

In today’s fast-changing healthcare world, to optimize revenue cycle management is vital. Providers face high costs, tough billing rules, and new patient needs. Strong RCM keeps finances steady, lifts patient trust, and meets rules. This guide shares clear steps and tested methods to boost revenue cycle management, so healthcare groups can grow in a tough market.

Understanding Revenue Cycle Management: The Foundation for Optimization

Revenue cycle management covers the full path of patient accounts, from first visit scheduling to final payment. Steps include registration, insurance checks, coding, billing, and collections. Each step helps providers get paid on time and with accuracy. A 2023 HFMA report found weak RCM can cut revenue by 15%. This shows the need to optimize revenue cycle management, fix errors, and speed workflows. With tech and telehealth growing, RCM must adjust to secure revenue and meet new rules.

The Key Components of Revenue Cycle Management

To optimize RCM effectively, it’s essential to understand its core components:

- Patient Access: Includes scheduling, registration, and insurance verification. Errors here can cause claim denials later.

- Charge Capture: Accurately documenting services provided to ensure correct billing.

- Coding and Billing: Translating medical services into standardized codes for insurance claims.

- Claims Management: Submitting claims and following up on denials or rejections.

- Payment Posting: Recording payments and reconciling accounts.

- Accounts Receivable Follow-Up: Managing outstanding balances and patient collections.

Each step must be refined to cut delays and errors that hurt cash flow and weaken finances. Using smart software can boost coding and billing speed, cut mistakes, and speed claims. Training staff on new coding rules is key to compliance and higher pay rates. As care shifts to value-based models, it is vital to optimize revenue cycle management, prove care quality, and track money results together.

Leveraging Technology to Streamline Revenue Cycle Processes

Technology drives better RCM results. Healthcare groups now invest in smart software to automate tasks and link all parts of the revenue cycle to optimize revenue cycle management.

Electronic Health Records (EHR) Integration

Linking EHRs with billing and coding tools creates smooth data flow and cuts entry errors. It also speeds claim filing. Real-time patient data lets staff check insurance fast, lowering denials by 20%. EHRs give doctors full patient views, so they decide with clarity and improve care. This also keeps billing records complete and helps optimize revenue cycle management for stronger results.

Automated Coding and Billing Software

Manual coding often causes errors that trigger costly denials. AI coding tools scan records and set accurate codes, boosting speed and accuracy. The AMA notes automation cuts coding mistakes by 30%, raising pay rates. These tools adjust to new rules and payer needs, lowering audit risks. By using them to optimize revenue cycle management, providers spend more time on patient care and less on admin tasks, building a stronger practice.

Claims Management Platforms

Advanced claim tools track claims live and flag problems early. Auto alerts on denials let staff act fast, cutting AR days by 12 on average per 2024 Black Book. These tools also give data on denial trends, so teams fix repeat issues and train better. By using data to optimize revenue cycle management, providers improve workflow, boost pay speed, and strengthen financial health.

Patient Payment Portals and Communication Tools

As patient costs grow, clear talks and simple pay options are key. Online portals let patients view bills, pay, and plan, lifting collections by 25%. They also teach patients about coverage, building trust. By using these tools to optimize revenue cycle management, providers boost revenue, improve patient ties, and gain loyalty and referrals.

Implementing Best Practices for Revenue Cycle Efficiency

Beyond tech, using strong practices is vital to optimize revenue cycle management. Standard steps, staff training, and active oversight drive better results.

Accurate and Timely Patient Registration

Errors in patient or insurance data cause many claim denials. Standard checks and trained staff cut mistakes. One large system cut denials by 40% with better access steps. Linking EHRs with registration also streamlines data and lowers errors. By using tech to keep data accurate and easy to reach, providers optimize revenue cycle management and smooth the process.

Regular Coding Audits and Continuous Education

Coding rules shift often, so staying updated is vital. Regular audits spot errors and guide fixes. Ongoing training keeps staff compliant with new rules. Simulation practice builds skill and confidence for real cases. These steps improve claim accuracy and help providers optimize revenue cycle management for better results.

Denial Management and Root Cause Analysis

Strong denial management means fixing claims and studying trends to stop repeats. A set team lifts recovery and smooths work. Root cause checks can cut denials 15–20% in a year. Data tools show common denial causes, so teams solve system issues, not just single claims. This proactive approach helps providers optimize revenue cycle management and build a culture of ongoing growth.

Optimizing Patient Financial Counseling

Talking about costs with patients early prevents payment delays. Counselors explain benefits, estimate costs, and set payment plans to build trust and lift collections. Digital tools like portals and cost estimators give patients control and clarity. Clear support boosts loyalty and trust, both key to a strong revenue cycle. By engaging patients in finances, providers improve collections, strengthen ties, and optimize revenue cycle management.

Measuring and Monitoring Key Performance Indicators (KPIs)

Tracking RCM with KPIs helps spot bottlenecks and measure gains. A strong KPI system builds accountability and steady growth. This proactive step lets providers adapt fast to financial shifts, keeping revenue cycles strong. By using KPIs to optimize revenue cycle management, organizations secure lasting efficiency.

Essential KPIs for Revenue Cycle Management

Some of the most critical KPIs include:

- Days in Accounts Receivable (AR): Measures the average time to collect payments.

- Clean Claim Rate: Percentage of claims submitted without errors.

- Denial Rate: Percentage of claims denied by payers.

- Net Collection Rate: The percentage of total potential reimbursement collected.

- Patient Collection Rate: Percentage of patient balances collected.

Regularly tracking metrics helps spot gaps and adjust plans. A high denial rate may mean staff need training or claims need review. A low clean claim rate shows issues in coding or records, calling for fixes. These steps enhance revenue and help providers optimize revenue cycle management.

Using Data Analytics for Continuous Improvement

Advanced analytics tools give deep insight into RCM. By tracking trends and linking data, leaders can refine workflows and use resources better. Predictive tools can forecast denials so teams act early. Machine learning spots billing patterns, boosting patient engagement and payments. Real-time dashboards show metrics fast, helping staff act quick and stay aligned. They reveal trends, wins, and gaps for growth. By building a data-driven culture, providers optimize revenue cycle management and secure long-term success.

Addressing Challenges and Preparing for the Future of RCM

While efforts to optimize revenue cycle management bring big gains, providers must still face ongoing challenges and get ready for future trends.

Adapting to Regulatory Changes

Healthcare rules and payer policies change often. To stay compliant, groups need agility and steady learning. Strong processes track updates and add them fast to RCM. This cuts penalty risks and builds trust with payers and patients. Regular training keeps staff ready for new rules. These steps help providers stay compliant and optimize revenue cycle management.

Managing Increasing Patient Financial Responsibility

With high-deductible plans rising, patients now pay more of their care costs. This shift demands clear billing and flexible pay options to keep revenue steady. Providers must share cost details upfront and use simple payment tools. Easy online systems let patients view bills, pay fast, and set plans that fit their budget. These steps build trust and help optimize revenue cycle management.

Embracing Artificial Intelligence and Machine Learning

New tech like AI and machine learning reshape RCM by automating tasks, boosting accuracy, and giving predictive insights. Early users see faster claims and fewer denials. AI scans large data sets to spot trends humans miss, guiding smart financial choices. As these tools grow, they will help providers optimize revenue cycle management across all steps, from registration to payment.

Fostering a Culture of Collaboration

To optimize revenue cycle management, clinical, admin, and finance teams must work together. Open talks and shared goals boost unity and cut silos. Regular meetings and joint projects build teamwork. Using shared tools keeps everyone updated on claims, accounts, and issues, raising efficiency across the cycle.

Trending Now!

Revenue cycle optimization helps healthcare teams reduce financial risk by improving processes from patient registration to payment collection. By refining front-end tasks like registration and insurance checks, mid-cycle steps such as coding and audits, and back-end functions like denial management and payment processing, organizations can speed up reimbursements, cut costs, and boost revenue. These improvements also support compliance with regulations and allow providers to reinvest in better care, technology, and staff resources.

Challenges such as poor standardization, staff training gaps, and weak communication can block efficiency, leading to denials and delays. To address these, healthcare organizations can use automation, AI, and analytics tools, while tracking KPIs like denial rates, clean claim rates, AR days, and collection rates. Streamlined workflows, stronger collaboration, and a culture of ongoing improvement ensure revenue cycle management remains efficient and sustainable in a changing healthcare landscape.

Conclusion

To optimize revenue cycle management, providers need tech, best practices, and steady tracking. Knowing the cycle and using smart tools boosts money health and patient care. A proactive culture helps teams adapt fast. As healthcare shifts, strong RCM will be key for lasting success.

Join Helpsquad Health to take the next step. Our team offers tools, support, and proven strategies to streamline your revenue cycle and boost financial results.