The Hidden Costs of Poor Claims Processing And How to Avoid Them

15 Jul 2025 By: Maria Rush

Updated

Revenue losses, compliance risks, and patient trust are on the line. Let’s talk about what’s really going wrong and how to fix it without burning out your team.

What’s Really Draining Your Practice?

Most healthcare providers focus on patient volume or insurance reimbursement rates when thinking about revenue. Totally fair. But here’s something we don’t talk about enough: how much money and time you’re losing on poor claims processing.

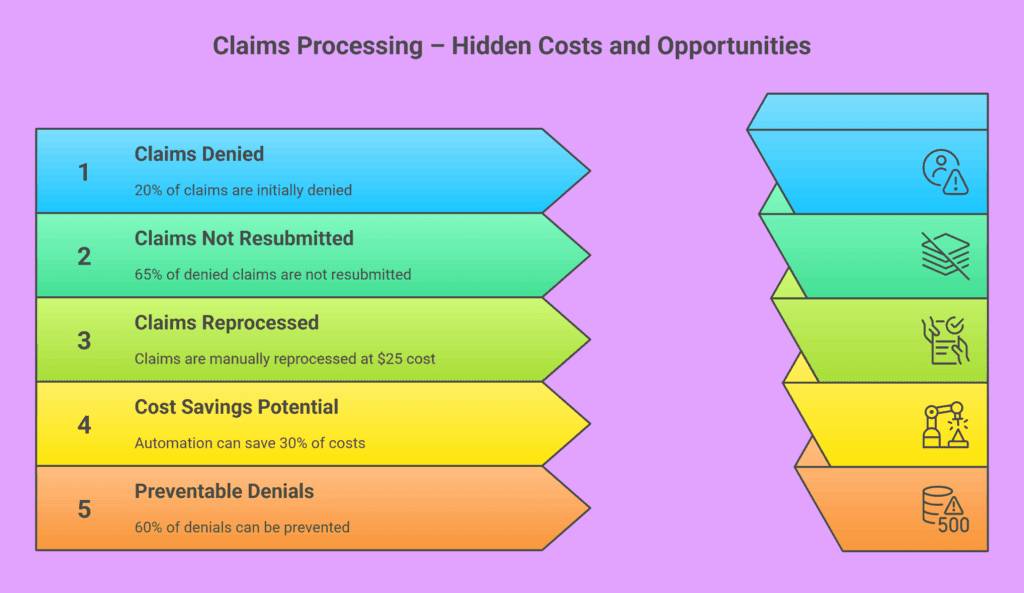

Almost 1 in 5 in-network medical claims get denied. And the kicker? Around 65% of those denials never get resubmitted. That’s real revenue, gone. Just… gone. And those denied claims don’t just mess with your cash flow they slow down your whole operation and frustrate your patients.

Let’s break it down. And more importantly, let’s talk about how to fix it.

The Financial Fallout

It’s Not Just a Paperwork Problem, It’s a Profit Killer

Reprocessing one denied claim can cost you $25 at the very least. Now multiply that by how many claims you handle in a month. It adds up fast. But the real loss? The ones your team doesn’t have time to chase down. That’s revenue you’ve already earned but you’ll never see it unless you have the systems (or support) in place to follow through.

And beyond the numbers? There’s the opportunity cost. Every hour your billing team spends on fixing denials is an hour they’re not using to improve processes, support staff, or expand services. Those missed chances to grow quietly chip away at your potential.

Operational Bottlenecks You Can’t See (But Feel)

The Hidden Time Sink in Your Revenue Cycle

We’ve all seen it: the team buried in claim resubmissions, chasing down info, and sitting on hold with insurance companies. Not only does this pull staff away from patient-facing work, it burns them out. Practices get stuck in reaction mode instead of focusing on growth or proactive care.

The longer it takes to fix one mistake, the longer it takes to get paid. And when that becomes your “normal,” scaling your practice feels impossible.

Those repetitive tasks? They’re a big reason why experienced team members leave. No one wants to do the same copy-paste work day in and day out. High turnover means you lose institutional knowledge, and spend time and money training someone new all over again.

Legal and Compliance Landmines

What You Don’t Know Can Get You Fined

Let’s be real; compliance is a full-time job. But if your claims processing are riddled with coding errors, incomplete records, or data handling issues, you’re opening yourself up to audits and penalties. Some practices have learned this the hard way, with fines reaching into tens of thousands of dollars.

And it’s not just the fines. Poor documentation can mess up your audit readiness and make litigation more expensive. If you don’t have a clean trail (timestamps, notes, evidence) it becomes way harder (and costlier) to defend your actions.

If your team is stretched thin, mistakes happen. That’s why a second layer of review or outsourcing to compliance-trained specialists can be a game-changer.

Patient Trust at Risk

When Billing Errors Undermine Quality Care

You could provide incredible care but if your patients get hit with a surprise bill or confusing claim denial, that’s what they’ll remember. And in a world where one bad review can snowball, keeping billing smooth and transparent is survival, and not just a nice-to-have.

And let’s not forget, patients today have megaphones. One unresolved claim can spiral into social media threads, Google reviews, and public complaints that linger online far longer than you’d like. Keeping claims processing smooth isn’t just about retention but reputation management, too.

The experience your patients have with billing is part of their care journey. Don’t let claims processing be the part that makes them walk away.

How to Avoid the Hidden Costs: Solutions That Work

Here’s where things turn around. If claims processing is bogging down your practice, you don’t need a magic wand. You need systems that actually work. Let’s focus on some high-impact areas:

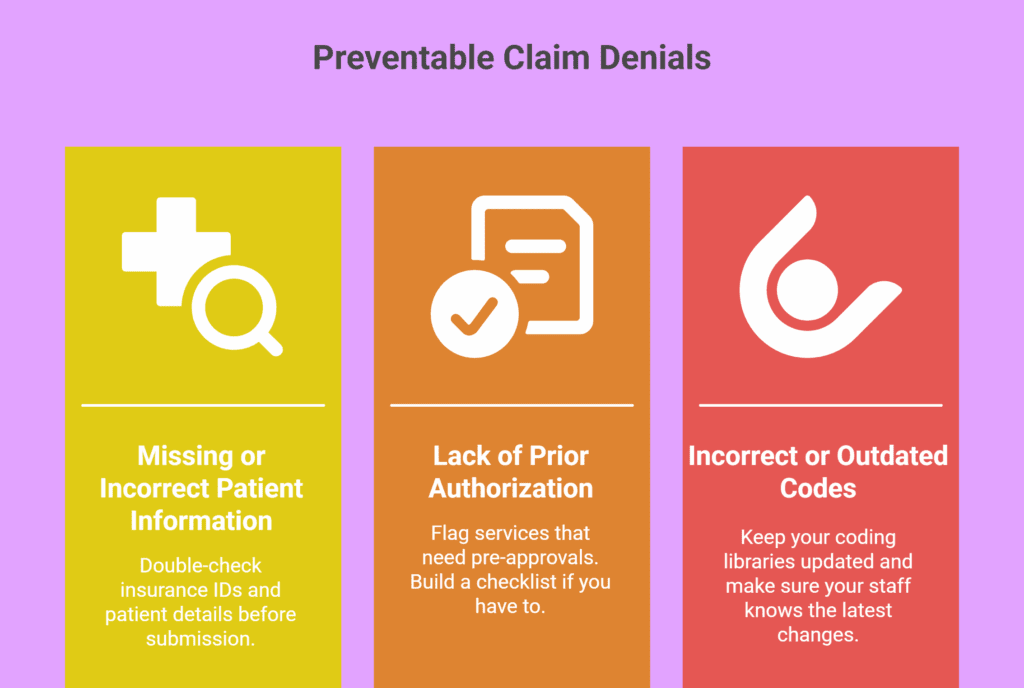

Clean and verify data upfront

This is the unglamorous but critical part. Validate insurance info. Check that patient details match what the insurer has on file. It seems basic, but small data errors cause a massive chunk of denials. Build a process for catching those before they cause a ripple effect downstream.

Use denial analytics and reporting

You can’t fix what you don’t track. Look at your denials over time. Are certain codes always getting rejected? Are specific payers harder to deal with? This kind of visibility helps you train your team smarter and avoid repeat mistakes. If your system doesn’t offer this insight, it’s time to upgrade or outsource to someone who can provide it.

Implement proactive denial management

Don’t let denied claims sit and collect dust. Create a simple system: track every denial, flag high-value ones, and assign deadlines for appeals. If that sounds like too much for your internal team to handle, this is exactly the kind of work that’s perfect for outsourcing.

Outsource to a specialized claims processing partner

This isn’t about giving up control. It’s about not trying to do everything yourself and doing the stuff that matters more. A partner like HelpSquad Health already has trained teams, denial tracking systems, and compliance workflows in place. You plug into a working machine. And just like that, your staff gets to focus on care, not corrections.

And if you’re looking to scale, outsourcing gives you more than extra hands. With automation, AI tools, and built-in analytics. Modern claims processing partners can help you move faster and smarter, without adding to your payroll.

Trending Now

The insurance industry is short on people and overwhelmed with complex claims. So it’s no surprise that companies are turning to AI to speed things up. And sure, automation helps. Claims get processed faster, fraud detection improves, and teams can finally breathe. The catch: when machines start making big decisions, like whether someone gets paid after an accident, transparency really matters.

A Nasscom Community insight digs into the risks of relying too much on black-box algorithms, how to balance speed with fairness, and what insurers can actually do to build AI systems that people can trust. The takeaway? If you’re going to use AI for claims, make sure it’s explainable, accountable, and still has real people in the loop.

Conclusion: Don’t Let Inefficiency Undermine Your Practice

You already have enough to deal with. Claims processing shouldn’t be the thing that breaks your revenue or burns out your team.

“Your greatest asset is your earning ability. Your greatest resource is your time.”

— Brian Tracy

If your current system is costing you time, money, and patient trust, it’s time to rethink it. And you don’t have to do it alone. At HelpSquad, we handle the entire claims processing cycle with accuracy, speed, and compliance in mind.

So you can stop chasing denials and start getting paid. Talk to us today.