Outsourcing Dental Insurance Verification: Boost Efficiency and Accuracy

28 Aug 2025 By: Mary Dellosa

Updated

In today’s busy dental field, handling admin tasks well is key to keeping a strong practice. One of the hardest jobs is dental insurance checks. With complex plans, policy changes, and the need for quick patient updates, offices often fall behind. Outsourcing dental insurance verification offers a smart way to boost speed and accuracy, letting dentists spend more time on care and less on forms.

Understanding Dental Insurance Verification

What is Dental Insurance Verification?

Dental insurance checks mean making sure a patient’s plan covers their care before treatment. This shows what’s paid for, co-pays, deductibles, and limits. Doing this right helps avoid denied claims, billing mistakes, and gives patients clear cost details they can trust.

Checks also confirm if the plan is active and if anything could block coverage, like hitting yearly limits. With this info, offices can plan care that fits each patient’s budget and build honest, open trust with them.

Why is it Important?

Insurance checks are a key part of running a dental office. The ADA reports that wrong or missing insurance details can cost practices thousands each year. Late or denied claims slow cash flow and add extra admin work. Careful checks help avoid these issues, making billing smoother and the patient visit easier.

The value of insurance checks goes beyond money. They also build trust and loyalty with patients. When people know their plan will cover care, they say yes to treatment. This trust leads to better oral health, as patients get care on time instead of waiting out of worry over costs.

Challenges in In-House Verification

Many dental offices check insurance in-house, but this brings many hurdles. Plans differ across providers, forcing staff to track endless details. Checks often mean calling insurers, which leads to long holds and mixed answers. High staff turnover and constant training needs make accuracy even harder.

The maze of insurance rules also sparks confusion, especially for care like braces or surgery. Small errors can cause big money losses for both office and patient. To avoid this, many offices now use automated tools or hire experts to handle checks, easing the load on their staff and speeding the process.

The Case for Outsourcing Dental Insurance Verification

How Outsourcing Works

Outsourcing dental insurance verification means working with experts who manage all coverage and benefit details. These teams use smart tools and trained staff to confirm info fast and link with practice software. This setup not only makes the process smoother but also gives offices real-time updates to adjust care as needed. Using cloud systems, providers offer 24/7 help, letting practices check insurance anytime, which is a big plus for urgent visits or last-minute changes.

Boosting Efficiency

Outsourcing saves staff time, letting them focus on care, scheduling, and key tasks. A 2023 Dental Economics survey found offices cut admin work by 40% with outsourcing. This boost leads to quicker check-ins and shorter waits. With less stress from insurance checks, teams can give patients more attention, raising satisfaction.

Since staff are free from dull tasks, they can spend more time connecting with patients. They can answer questions, ease worries, and give a personal touch. This stronger bond builds trust, loyalty, and keeps patients coming back.

Enhancing Accuracy

Accuracy matters most in insurance checks to avoid denied claims. Outsourcing firms use trained teams who know policies and follow strict steps. They also use smart tools that cut human errors. A study in the Journal of Dental Practice Management showed outsourced checks lowered denials by 30%, boosting revenue flow.

These firms also track rule changes to keep practices compliant and informed. This lowers risk, improves payback, and keeps cash steady. With rules always shifting, having experts in insurance checks can transform how a practice stays stable and grows.

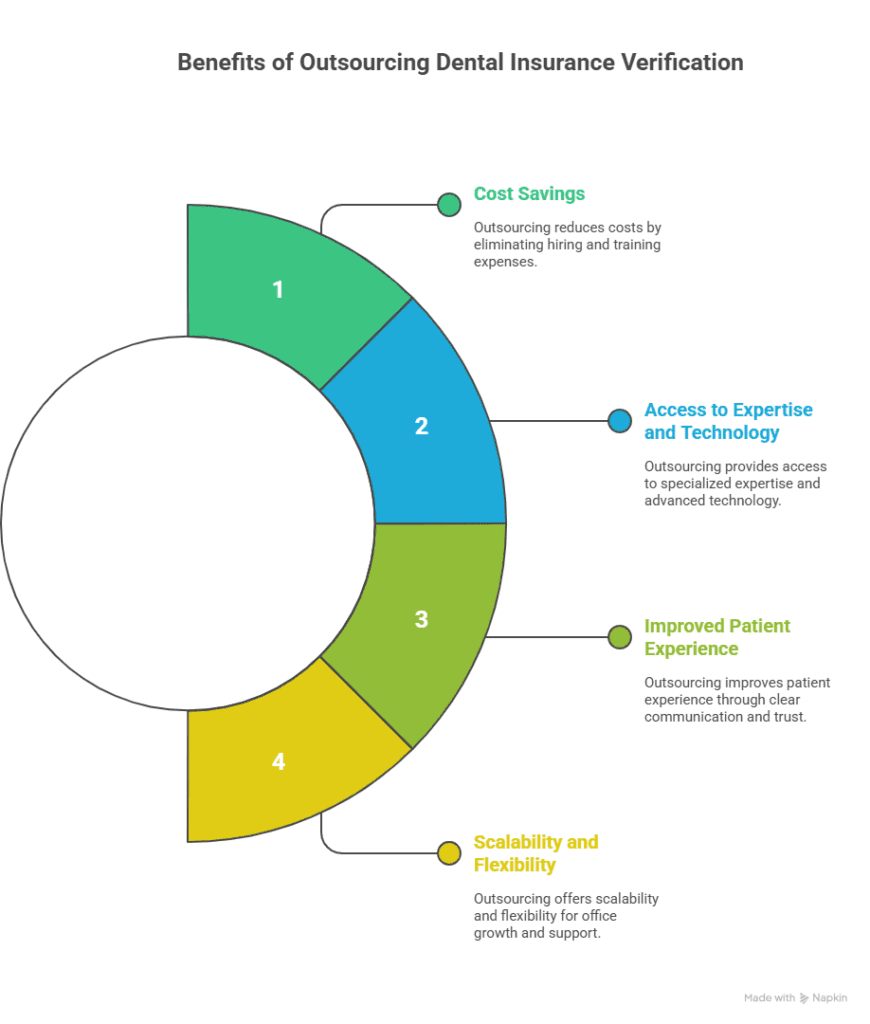

Key Benefits of Outsourcing Dental Insurance Verification

Cost Savings

Outsourcing may cost at first, but many dental offices find it saves more than running an in-house team. It removes the need to hire, train, and pay extra staff. Fewer denied claims and quicker payments also keep the office financially strong. With the money saved, practices can put more into patient care and new dental tools, giving patients better service and results.

Access to Expertise and Technology

Outsourcing partners focus only on insurance checks and keep up with changing rules and policies. They use tools like AI and real-time data that most offices can’t afford alone. These teams also bring skilled staff who know the ins and outs of complex insurance systems, giving practices the benefit of deep experience. Their knowledge helps spot problems early, keeping office work smooth and free from big delays.

Improved Patient Experience

Patients value clear details on coverage and costs before care. Outsourcing helps offices share accurate info fast, cutting confusion and building trust. Clear updates raise patient loyalty and satisfaction. When people feel informed and cared for, they often refer friends, boosting the office’s name and drawing new patients.

With smoother insurance checks, dental teams spend less time on paperwork and more time with patients. This creates a friendlier, more efficient office that puts care first.

Scalability and Flexibility

Outsourcing gives dental offices room to grow in ways in-house teams can’t. Whether the office is expanding or hits busy seasons, partners adjust with ease. This keeps service steady and staff free from stress. Outsourcing also adds support like handling special plans or stepping in during peak times.

With this flexibility, offices can care for patients smoothly, no matter the ups and downs. It helps ensure every patient feels supported and well cared for.

How to Choose the Right Outsourcing Partner

Evaluate Experience and Reputation

Choose providers with a strong history in dental insurance checks. Look at client reviews, case studies, and certifications to gauge their skill and trust. Experienced firms often have tested systems that bring steady results. You can also check forums or review sites where dental pros share honest feedback.

Talking with peers in the field may give useful tips and warnings about partners. This insight can guide you to a reliable choice that fits your office best.

Technology Integration

Make sure the outsourcing partner’s tools work well with your practice software. Smooth data sharing cuts manual work and errors, making checks faster. Ask if they use automation and real-time updates. Also check if they can grow with new tech as dental insurance keeps changing.

A partner focused on innovation will help your office stay ahead and run more efficiently. This support keeps your practice competitive and ready for the future.

Compliance and Security

Managing patient insurance details requires strict HIPAA compliance. Make sure your outsourcing partner follows strong security rules to keep data safe. Ask about their response plan if a breach happens. Knowing how they handle risks and protect sensitive info builds trust and keeps your office compliant.

Transparent Pricing and Service Levels

Be sure you understand how pricing works and what’s included. Some providers bill per check, others use a monthly plan. Ask how fast they respond, how accurate they are, and if support is always there. Also, check there aren’t hidden fees that could surprise you later.

When pricing is clear and honest, it’s easier to trust your partner and plan ahead. That peace of mind lets your team focus on patients, not paperwork or costs.

Assess Communication and Support

Strong communication is the heart of a good outsourcing partnership. See if they answer quickly and truly care about your questions and concerns. The best partners give you one person who knows your practice well and is always ready to help. Regular updates and check-ins keep everything running smoothly and fix little issues early, so your team can give full attention to patients.

Scalability and Flexibility

As your practice grows, your outsourcing needs will grow too. Choose a partner who can scale their services with you. Ask if they can handle more verifications or add new services as your office changes. A flexible partner helps you adjust quickly to shifts in the market or your practice, making sure you always have the support needed to succeed.

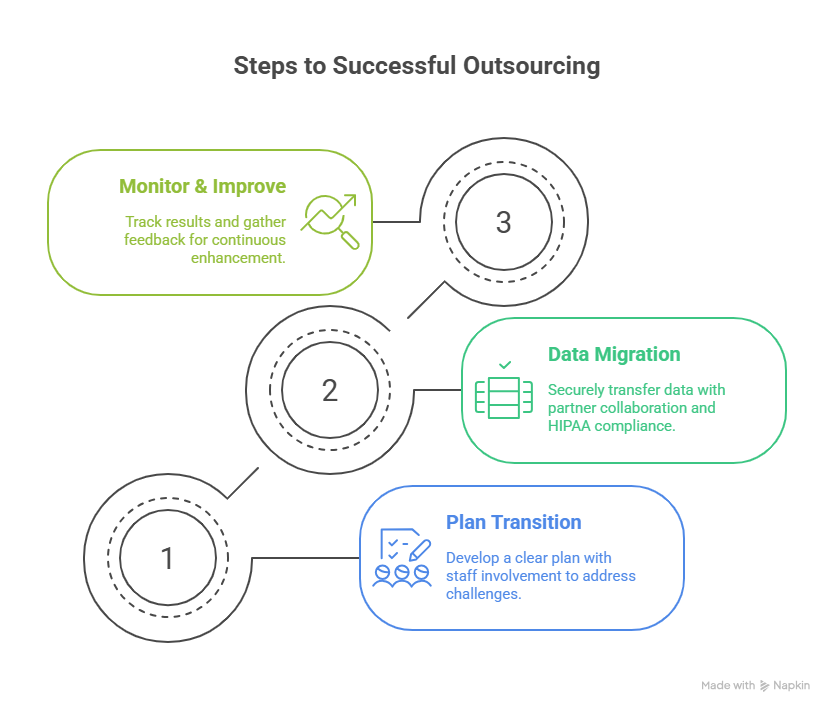

Implementing Outsourced Dental Insurance Verification

Planning the Transition

Outsourcing dental insurance verification is easier with a clear plan. Start by looking at how your team handles checks now and where things get tough. Share the plan with your staff, set expectations, and train them on any new tools. Involving them early helps uncover challenges and smart ideas you might not see. Team meetings or workshops give everyone a voice and make the change feel smoother and more supportive.

Data Migration and Integration

Work closely with your outsourcing partner to move patient and insurance data safely. Test the system to be sure info flows right and set rules for fixing errors. Make sure all steps follow HIPAA rules during the move. This may include using encryption and doing audits to protect sensitive data. Create a clear checklist of each step to guide both your team and the partner, so nothing is missed.

Monitoring and Continuous Improvement

After setup, track results like turnaround time, claim denials, and patient feedback. Keep open communication with your partner to fix issues and improve. Set up a feedback loop with monthly meetings to review data and find solutions together. Also, ask patients about their experience to spot areas to improve and boost satisfaction. By focusing on constant growth, your practice can keep pace with insurance changes while delivering great care.

Trending Now

Many dental offices lose money and time due to poor insurance checks. Manual work leads to burnout, slow payments, and denied claims. Missed steps often go unseen until it’s too late.

Conclusion: A Strategic Move for Modern Dental Practices

Outsourcing dental insurance verification is more than passing off a task—it’s a smart choice that can reshape how a practice runs. With expert help, new tools, and flexible support, offices can work faster and more accurately. This means stronger finances, happier patients, and a team that can focus fully on care.

Outsource dental insurance checks with HelpSquad Health to save time, cut errors, and boost profits. Their team handles it so yours can focus on patient care.