CSR in Insurance: Maximizing Cost-Sharing Reduction for Policyholders

05 Feb 2025 By: Maria Rush

Updated

If you’ve ever looked at your health insurance bill and thought, “Why is this so high?” you’re not alone. That’s why cost-sharing reduction or CSR in insurance is important to understand.

CSR helps lower-income individuals cut down on out-of-pocket costs. Things like deductibles, copays, and coinsurance. It’s a real lifeline for people who qualify.

The problem? A lot of policyholders don’t even know it exists. Or they think they’re not eligible. That misunderstanding costs them money, sometimes hundreds or thousands a year.

In this article, let’s talk about what CSR actually is, why customer support matters, and how insurers can help people use it the right way.

What is Cost-Sharing Reduction or CSR in Insurance?

CSR helps lower the amount people pay when they visit a doctor or fill a prescription. It covers part of the costs like deductibles, copays, and coinsurance.

To qualify, you need a Silver-tier health plan under the Affordable Care Act (ACA). If you qualify, your plan becomes more affordable. You pay less each time you get care.

For many families, that’s the difference between going to the doctor and putting it off.

The Importance of Customer Support in CSR

Customer support plays a huge role in helping people understand CSR.

Agents who know how CSR in insurance works can explain it in plain language, what it is, who qualifies, and how to apply. That’s what makes customers trust their insurer.

Good support teams don’t just answer calls. They educate customers.

They make sure people don’t miss out on help they’re already entitled to.

24/7 support, multiple languages, and clear guidance, these things matter. They help people make smart choices about their plans and save real money.

How does cost-sharing reduction works?

CSR is for people who:

- Buy a Silver-tier plan through the ACA Marketplace

- Have a household income between 100% and 250% of the Federal Poverty Level

- Aren’t eligible for Medicaid or an employer plan

If that’s you, your deductibles and copays go down automatically.

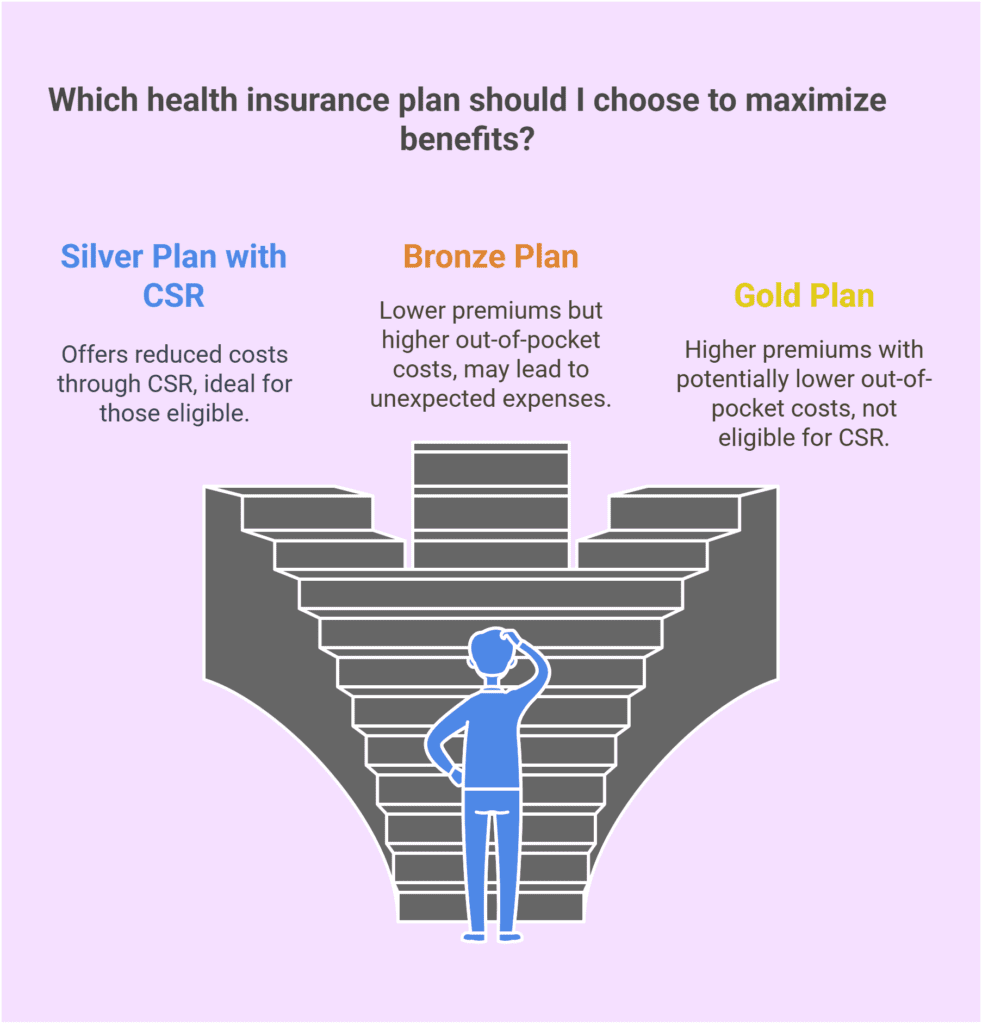

But here’s where it gets tricky: cost-sharing reduction only applies to Silver plans.

Many people don’t know that and pick Bronze or Gold instead.

Those plans might look cheaper at first, but they don’t include CSR benefits.

When CSR payments were paused a few years ago, enrollments in Silver plans dropped in almost every county. People switched to Bronze for the lower premium, then got hit with bigger out-of-pocket bills later.

It shows how important clear customer support really is. One good conversation with a trained agent could have saved them from that mistake.

Challenges Policyholders Face with CSR Plans

Even with good benefits, CSR can be confusing.

Here’s what people struggle with most:

- Eligibility confusion – They don’t know they qualify.

- Mixing up CSR with tax credits – CSR cuts out-of-pocket costs, while tax credits lower premiums. Two different things.

- Unexpected bills – They think a service is covered when it isn’t.

A Kaiser Family Foundation survey found that nearly half of insured adults had issues with their coverage. Some couldn’t get care. Others paid more than expected.

That’s why customer support isn’t optional. People need someone to explain things before they make costly mistakes.

The Role of Customer Support in CSR Optimization

Customer service reps (CSRs; different kind of CSR!) make the biggest difference here.

They:

- Explain CSR in insurance options clearly

- Help customers understand what’s covered

- Offer live help through chat, phone, or email

- Guide multilingual clients through complicated terms

McKinsey found that 20% of customers would leave their insurance company if their advisor quit. That’s how much trust people put in a single good rep.

When insurers educate their customers instead of just selling them a plan, they build loyalty and save everyone a lot of stress.

Trending Now

The health insurance industry is changing fast. Costs are rising. Regulations keep shifting. Many companies now outsource or co-source customer support. It cuts costs and helps them scale faster without losing quality.

Third-party administrators and managing general agents also help insurers grow into new markets. But outsourcing comes with risks, like losing control or facing data issues.

The key is to pick the right partners, set clear terms, and monitor performance closely. Done right, outsourcing helps companies stay flexible and compliant while improving customer service.

How 24/7 Customer Support Improves CSR Accessibility

People don’t just have questions during business hours.

Here’s how insurers can make CSR easier to understand and access:

- Live Chat & Instant Support: Quick answers keep customers from getting frustrated.

- Phone & Email: Help people check eligibility before choosing a plan.

- Multilingual Service: Make it easier for everyone to understand their benefits.

- Proactive Education: Don’t wait for customers to ask. Reach out and explain.

A Carenet Healthcare study found that faster service and shorter wait times are what customers want most.

When insurers invest in strong, always-on support, satisfaction goes up and so does retention.

The Future of CSR in Health Insurance

CSR isn’t just about today’s bills. It’s about how the industry evolves.

Here’s what’s coming:

- Technology-Driven Transparency: Better data helps people see how their income and choices affect costs.

- Personalized Digital Help: Chatbots and virtual assistants giving quick, clear CSR in insurance info.

- Better Education: Simple, accessible resources that actually make sense.

- Community Engagement: Working with nonprofits to spread awareness and make healthcare more affordable.

The Role of HelpSquad in Supporting CSR Initiatives

At HelpSquad, we see CSR in insurance as more than a policy. It’s a promise to help people.

Our 24/7 customer support helps insurance providers:

- Cut wait times so customers get help fast

- Improve satisfaction with clear explanations

- Keep policyholders loyal and informed

According to the American Customer Satisfaction Index, health insurance satisfaction recently hit a record high. That’s no coincidence, better support leads to happier customers.

Conclusion

CSR helps make healthcare affordable for the people who need it most. But it only works when policyholders understand it.

That’s why customer support is so important. Clear communication, proactive education, and around-the-clock help make a real difference.

If you’re an insurance provider looking to improve your customer experience and help clients make the most of CSR, we can help.

Talk to us and see how 24/7 customer support can help your policyholders save more and stress less.

FAQ

What is cost-sharing reduction or CSR in insurance?

Cost-sharing reduction (CSR) is a federal program that helps lower-income individuals and families pay less for healthcare services. It reduces out-of-pocket expenses such as deductibles, copayments, and coinsurance. To qualify, policyholders must enroll in a Silver-tier plan under the Affordable Care Act (ACA) and meet specific income requirements (100%–250% of the Federal Poverty Level).

How does CSR make health insurance more affordable?

CSR directly reduces the amount people pay when they see a doctor or fill prescriptions. Instead of lowering monthly premiums like tax credits, CSR lowers the cost per visit or service. For many families, this can mean the difference between getting timely care and delaying treatment due to cost.

Why is customer support important for CSR awareness and access?

Many policyholders don’t know CSR exists or don’t realize they qualify. Strong customer support teams play a vital role in educating customers. Explaining CSR eligibility, plan types, and benefits in plain language. Agents who understand CSR help prevent costly mistakes, such as choosing Bronze or Gold plans that don’t include these savings.

How can insurers improve CSR accessibility with 24/7 customer support?

Round-the-clock support ensures people get answers when they need them most. Live chat, phone, and multilingual service make CSR easier to understand and access. Proactive outreach, educating customers before enrollment, helps them select the right plan and avoid unnecessary costs.

What does the future of CSR in health insurance look like?

The future of CSR is becoming more tech-driven and personalized. Insurers are adopting chatbots, virtual assistants, and AI-based tools to simplify CSR education. At the same time, companies like HelpSquad are providing 24/7 live customer support outsourcing to help insurers explain benefits clearly, boost satisfaction, and retain policyholders.