Unemployment Insurance During COVID-19

30 Apr 2020 By: Shelby Shaffer

Updated

March 10, 2020. The date will stick out in Lowen Anders’ head for years. It’s the date she got the call that said schools were closing because of COVID-19. Lowen was laid-off.

Lowen had been a freelance contractor for the New York City school system for six years teaching architecture in elementary and middle schools. She loved her students and her passion for architecture was contagious. But thanks to COVID-19, her school year teaching was cut short, forcing her to apply for unemployment.

Unemployment is a harsh reality for individuals all across the country and the world as more businesses are closing their doors to COVID-19.

Up until now receiving unemployment checks had a negative stigma. However, in the current situation, when many Americans are forced to stay home and not work, filing for unemployment insurance is the norm. But even though so many Americans are experiencing the same hardships right now, not many truly understand what benefits they’re entitled to or how their employment rights have changed thanks to COVID-19.

A Brief History of Unemployment Insurance in America

Over 26 million Americans have lost their jobs or had their hours cut significantly because of COVID-19. In the first week of the nationwide shutdown, over 4.4 million Americans filed for unemployment.

Devastating as it is, this is not an entirely unprecedented situation. America faced its fair share of unemployment waves. In 1933, during the Great Depression, the U.S. saw its highest rate of unemployment at 24.9%. Unemployment remained above 14% from 1931 to 1940 and then remained in the single digits until September 1982, when it reached 10.1%. Then in October 2009, during the Great Recession, unemployment rested at 10%. (The Balance)

Today, the unemployment rate falters around 13%. As of April 24, 2020, more than 26 million Americans filed for unemployment insurance, but not all those applicants know what that involves.

What is Unemployment Insurance?

In short, Unemployment Insurance (UI), or more commonly known as unemployment benefits, is a cash payment allocated to eligible workers who become unemployed through no fault of their own, like the COVID-19 pandemic. Additionally, individuals have to meet certain eligibility requirements to be considered. (CareerOneStop)

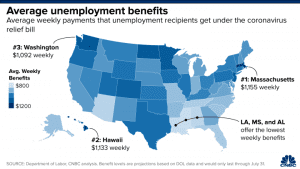

Traditionally, the U.S Department of Labor, together with the individual state agencies, administers UI. Each state sets a maximum amount of benefits and determines each individual’s eligibility based on his or her earnings over the recent 52-week period. Additionally, due to the current COVID-19 crisis, federal law now provides unemployment benefits for self-employed, gig employees, and freelance workers and adds an additional $600 to weekly benefits to those individuals already receiving state unemployment benefits.

Image from CNBC

This means that now, freelancers like Lowen, gig employees, and self-employed professionals are eligible to receive unemployment. This is great news because as of 2018, 57 million Americans considered themselves freelance workers, 57 million identified as gig-workers, and 42 million declared self-employment.

Without the current federal extension, all of these newly eligible unemployment benefit recipients would have no income and no means for survival during the quarantine.

How did COVID-19 Change Unemployment Insurance?

Before COVID-19 left so many Americans jobless, the eligibility standards for unemployment insurance were much higher. Current crisis brought some changes to the programs.

In March 2020, new federal law greatly expanded unemployment insurance. Many employees who were not previously covered are now eligible. Changes include:

- Employer permanently or temporarily laid you off due to coronavirus measures

- Employer reduced your work hours due to coronavirus measures

- Employees who are self-employed and have lost income due to coronavirus measures

- Employees who are quarantined and can’t work due to coronavirus

- Employees who are unable to work due to a risk of exposure to coronavirus

- Employees who can’t work because you’re caring for a family member due to coronavirus

In addition to expanding eligibility, new federal law also:

- Increases the weekly benefit amount that states currently provide by $600, until July 31, 2020

- Provides an additional 13 weeks of benefits for people who are still unemployed after their state benefit period runs out

More Eligibility Means More Claims

While new federal law made it easier for more employees to be eligible for unemployment insurance, the resources available are still limited.

Diane Swonk, chief economist at the auditing firm Grant Thornton, said many laid-off employees have yet to file for benefits because state unemployment portals are unable to handle the wave of traffic they are now receiving. (NBC News) Many laid-off employees are still waiting for their first unemployment insurance check. Official numbers state that merely 14.2% of the 668,000 claims filed since March 15 were paid out. (Forbes)

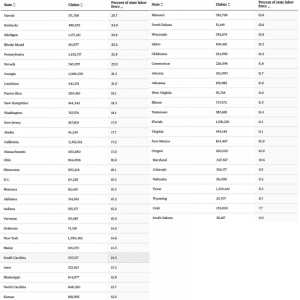

Additionally, experts warn the job losses will likely get worse. Oxford Economics forecasts that the unemployment rate will rise to 16% by May. Experts also noted that several states are more vulnerable to a severe economic shock. The shock is attributed to a combination of factors, including older populations, the significant reliance on retail or hospitality, or limited work-from-home possibilities. (NBC News)

Image of claims filed and percentage of labor force by state

State unemployment offices continue to report that they’re having difficulties keeping up with the unprecedented demand. The governor of New York, Andrew Cuomo, announced the implementation of a communication strategy that supports NY residents efficiently. The governor said that the state employed over 1,000 additional people “just to take the incoming unemployment calls. That’s how high the volume is. And [unemployment officers] still can’t keep up.” ( Forbes)

The strategy of extensive coverage of unemployment phone lines could be a helpful tactic for other states to implement. Whether it’s hiring on more support staff or opting for an online chat portal

CARES Act and PUA

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), an economic stimulus package providing over $2 trillion to aid Americans affected by the COVID-19 pandemic.

The CARES Act creates a temporary “Pandemic Unemployment Assistance” (PUA) program funded by the federal government. This means individuals who wouldn’t normally be eligible for unemployment insurance may now qualify.

The Pandemic Unemployment Assistance covers individuals who are ready and available to work but are unemployed or partially unemployed for one of the following reasons:

- The individual has been diagnosed with COVID-19 or is experiencing COVID-19 symptoms and seeking a medical diagnosis;

- A member of the individuals household has been diagnosed with COVID-19

- The individual is providing care for a family member who has been diagnosed with COVID-19

- The individual is the primary caregiver for a child who is unable to attend school or a daycare facility that has closed as a direct result of COVID-19

- The individual is under quarantine imposed as a direct result of COVID-19

- The individual was scheduled to begin employment and does not have a job or is unable to reach the job as a direct result of COVID-19

- The individual has become the breadwinner for a household because the head of the household has died as a direct result of COVID-19

*For additional requirements, visit uc.pa.gov/COVID-19

Updating Unemployment Insurance is Just the Beginning

“I compare [the current situation] to a natural disaster, a terrorist attack and a financial shock all at once,” said Gregory Daco, chief U.S. economist at Oxford Economics. “We’ve never had this in history.”

It’s not a secret that this travesty blindsided us. No one can say for sure how long the COVID-19 pandemic will last. The U.S state and federal government agencies are still figuring out how to deal with the current situation. But what’s to come after this pandemic ends?

All we know is the updated unemployment insurance is only the tip of the iceberg when it comes to COVID-19 relief efforts.

Related Blogs

25 Apr

25 Apr Customer Service

The Role of BPO in Enhancing Patient Engagement Software

In the evolving healthcare technology field, patient engagement software is essential. It improves interactions between patients and providers. Business Process Outsourcing (BPO) also plays an important role. It streamlines tasks like scheduling and billing. This helps healthcare organizations focus more on care and operational efficiency. It’s crucial for providers to understand the connection between BPO … Continued

24 Apr

24 Apr Customer Service

Leveraging Business Process Outsourcing for Electronic Health Records Management

In the fast-paced healthcare sector, combining Business Process Outsourcing (BPO) and Electronic Health Records (EHR) is crucial. This strategy boosts operational efficiency and improves patient care. Healthcare organizations are using this tech synergy to streamline operations. The mix of EHR systems and BPO services optimizes data handling and transforms service delivery. This article examines the … Continued

23 Apr

23 Apr Business Process Outsourcing

7 EHR efficiency strategies to reduce documentation time

To boost EHR efficiency and cut documentation time, adopt these seven strategies: streamline workflows, use templates, train staff effectively, integrate voice recognition, apply AI tools, standardize data entry, and regularly review processes. These methods enhance productivity, reduce errors, and save valuable time for healthcare providers. Understanding EHR and Its Importance EHRs provide a digital way … Continued